Research and advocacy of progressive and pragmatic policy ideas.

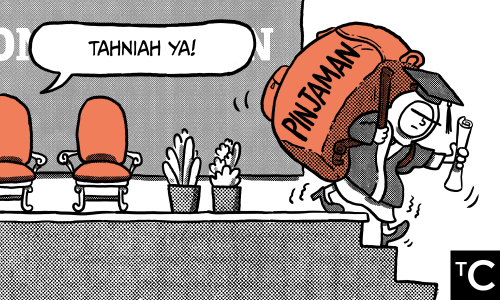

Stories from an Indebted Generation

In our four-part research series, we wrote about the burden borrowers carry from student loan debt. Now, we present, in their own words, the impact of student loans on their lives.

By Ooi Kok Hin & Joey Goh7 April 2022

In our four-part Indebted Generation research series, we addressed the quandary of student debt and recommended some key policy changes towards resolving problems related to current outstanding loans as well as longer term systemic issues with how higher education is financed in Malaysia. We also highlighted the declining – and increasingly less secure – returns of higher education in a labour market which is today beset with stagnant wages and underemployment. These developments are making a sizeable number of borrowers question the worth of their tertiary education relative to their student loans.

To better understand their views on student loan and its impact on their lives, we conducted a survey among borrowers last year. Among the survey’s findings was the split reaction among respondents about the worth of their education that were paid for via student loans: 59% agreed that it was worth the loans incurred, while 41% disagreed. Borrowers whose income is lower than RM2,000 a month were especially likely to question the worth of their education. We found this mixed response interesting and followed up with several respondents through interviews and focus group discussions. In this illustrated piece, we share a selection of what they told us about the factors that drove them to sign up for student loans, the challenges they face in repaying their loans, and the policy changes they hope to see with regard to higher education financing in Malaysia.

* Some names mentioned in this piece are pseudonyms of the borrowers who participated in the interviews and focus group discussions. Quotes have been lightly edited for clarity and brevity.

Borrowers from low-income families tend to choose student loans as the default option to finance their higher education

Many student loan borrowers come from low-income households, a fact which is confirmed by both PTPTN’s survey as well as ours. When we asked about their family background during focus groups, some participants shared that they took up loans so that they did not have to burden their parents who were already struggling to make ends meet.

“We were in the lower middle income. My father was the sole breadwinner. I can figure out that he was struggling to make an allocation to pay for our studies because me and my sister were going to university at around the same time. We have another three brothers growing up. So yeah we were struggling financially, and hence I decided to take up student loans to not add to that burden.” – Shima

“After matriculation, I received an offer for university. Finance was a big problem for me at the time because my family was B40. My mom was a housewife. My dad had this small business (restaurant), and siblings were all studying at the time. I opted for PTPTN because I didn’t have much knowledge on scholarships either. I also took PTPTN loans for my master’s degree. So the total loan is around RM 43,000 plus interest.” – Hafizah

“The combination of unmet higher earnings potential and the burden of student debt seems to impact B40 borrowers disproportionately. PTPTN’s own study revealed that 97% of the loan defaulters surveyed were from the B40 income group. Defaulters cited high debt obligations and low income as the primary reasons for their non-payment.” – Indebted Generation, Part 1

Low-income students lack the know-how to access financial aid opportunities

We also found from the interviews and focus groups that students from low-income families lack awareness regarding scholarship and financial aid opportunities when it comes to tertiary education. Their parents do not know how to guide them since they did not attend university and had no knowledge of the process. Even when the students are aware of such opportunities, they lack the know-how, and in some cases, rule themselves out of applying because of low self-confidence and perceived inadequate results. Some borrowers shared that if they had known more about scholarship and financial aid opportunities, they would not have taken up the loans.

“I wasn’t the brightest student, and I did not know that many scholarships options. No one taught me to look at scholarships offered by MARA and state governments. On the first day of my foundation (asasi) registration, we were already given documents for student loan applications. “You just need to sign,” they said to us. After taking out the loan, I feel cheated because actually we have to pay back more. Nobody mentioned to me about the interest rate and I was not aware of how it is calculated. Now I tell people that if they can do part time jobs or apply for scholarships, just do it and refrain from getting PTPTN loans. I did that for my younger brother as when he wanted to pursue higher education, we knew better options already and applied for various things, like zero-interest financing by state governments. He didn’t take a PTPTN loan." – Shima

"My parents did not know how to advise me about college because they didn’t get to attain tertiary education. What happened was I got good SPM results, then by chance there’s this one lady at an agency who recommended me to look into needs-based scholarship and PTPTN loans. So I got a merit-based scholarship which partially covered the fees, and then PTPTN loans covered the rest. Total cost was about RM 90,000; we did not realize it’d be such an expensive option. But still, I wouldn’t have been able to complete my program, even after getting the partial scholarship, had it not been for PTPTN." – Wong

For some, anxiety kicks in when they had to wait a long time to secure decent jobs

Graduate unemployment has been on an upward trend since the last four years. Coupled with loan repayment, this has caused a great deal of stress and anxiety amongst the borrowers who struggle to secure jobs with decent pay in their chosen fields.

Among other things, our respondents recounted the harsh tone that was used to label defaulters, which in some cases were intended to shame them for not repaying, when the reality was that they were struggling to make ends meet.

“Upon finishing, I did not work for 6 months and just helped my mom and supported my siblings. My father told me to wait to get something suitable in the field that I studied for. I actually started out with a RM 1,800 salary in Johor. Have to pay rent, plus I have to support my family back home. I didn’t pay back the loan initially as I was really struggling, and my younger brothers need my financial support also. I just tried to juggle everything and made sure everybody survived. I was in a bad financial situation and terima letter to remind me to pay back; there’s a warning, the tone is very penalising.” – Shima

“After my degree, I was unemployed for a few months. The same thing happened after I completed my master’s degree, and I was unemployed for six months. When I started kerja, I only got RM 2,500 with a master’s degree. Fortunately, after six months, I was lucky to receive a better offer. Tak semua orang akan ada the same opportunity, so PTPTN should take that into consideration. Sekarang gaji RM 1,800 pun tak tentu cukup makan, and benda ini (hutang pinjaman pendidikan) akan affect our monthly finances.” – Hafizah

“My first job paid roughly RM 2,500. I did feel some anxiety about my capability to repay back the loan, especially during the first (uncertain) year in the job market.” – Wong

“I was able to secure a temporary job 3 months after I finished my studies. But it took about 9 months to secure a job that suits my degree.” – Amalia

“I didn’t secure a job until about a year after I graduated. I was looking for a job for a while, and was doing some stuff part time. I admit that I didn’t fully pay my monthly loan repayments and there were some months that I did not make payments at all.” – Emma

“The 2018 Malaysia’s Graduate Tracer Study (SKPG) showed that almost 60% of graduates were or remained unemployed a year after graduation. PTPTN also found that more than one-third of their surveyed respondents earn below RM2,000 a month. More seriously still, the combination of unmet higher earnings potential and the burden of student debt seems to impact B40 borrowers disproportionately as about 97% of the loan defaulters surveyed by PTPTN were from the B40 income group.” – Indebted Generation, Part 2

Loan burden is a source of financial stress for B40 borrowers and targeted loan cancellation can help ease their burden

As stated by PTPTN, 55% of all its borrowers are from the B40 community. During interviews, our respondents expressed mixed reactions towards our policy recommendation to provide targeted and partial loan cancellation to alleviate the burden of low-income borrowers.

Some of the respondents are of the opinion that a loan cancellation would not only bring about a positive impact on the borrowers, but also help secure the future of their families. However, others told us that such a policy should come with conditions.

“Growing up poor, we couldn’t even afford birthday cakes. Financial burden carries on in the family. Cancelling student loans for B40 students would greatly convenience their later adult lives because not everyone starts from the same level. It has a tremendous trickle down effect on generations to come.” – Wong

"Setuju (dengan penghapusan hutang) dengan syarat peminjam berjaya menghabiskan pengajian dengan cemerlang, aktif dalam kokurikulum, berakhlak baik, telah mendapat pekerjaan namun bergaji kecil, menunjukkan kesungguhan untuk membayar kembali pinjaman walaupun dalam jumlah yang kecil." – Syah

"In order to abolish such debt, there must be something to be given back by the borrowers. Perhaps like working with government bodies etc." – Amalia

“I believe you have to ‘give back what you owe’, but at the same time, I understand why some people cannot afford to pay back as I have been in their situation before. The whole experience of getting warning letters was very penalising. I believe ample time should be given for repayment, and borrowers should have the option to renegotiate their tenure, amount, and grace period. After all, they are not a bank!” – Shima

“Malaysia can and has implemented student debt cancellation to achieve assorted policy aims. To incentivise high levels of academic achievement, full loan cancellations have been offered since 2003 for PTPTN borrowers who complete their Bachelors’ degree with first class honours. To incentivise quicker loan repayments, partial loan cancellations have been offered since 2013 for PTPTN borrowers who can settle their loans in one lump sum or who repay their loans consistently. There was even partial student loan cancellation offered for lower income borrowers aged 60 and over in the 2019 Budget speech.” – Indebted Generation, Part 2

They want higher education to be less expensive and the current loan system to be reevaluated

When asked about policy changes they would like to see, most of them expressed hope for a more affordable, if not free, higher education which emphasises a needs-based approach. Some of them also called for the government to rethink its current higher education financing policy, which is heavily dependent on the loan system.

“To me, education and health are something the government should provide for us. Okay je if they don’t provide cost of living allowance, as long as tuition fees and yuran asrama are covered. If not free for everyone, at least free for targeted groups like B40. Targeting the right group to receive subsidies is very important because jurang pendapatan kita banyak." – Hafizah

"Education in general is a public good. Undergraduate attainment should be free because it has more trickle down effect on one’s life than one can measure." – Wong

“I agree that we can afford to provide free education for our nation as long as we have a proper tax system and we let the experts run the education planning. For me, free education means every citizen is allowed to pursue education for free in any government institution with minimal fees for administration purposes.” – Amalia

“Tak setuju dengan pendidikan tinggi percuma kerana negara hanya wajib menyediakan pendidikan asas percuma saja sebagai keperluan kepada semua kanak-kanak. Untuk pendidikan tinggi, rakyat bebas memilih untuk meneruskan pengajian di peringkat tinggi atau tak. Bagi saya, keutamaan kerajaan harus kepada menolong peminjam golongan berpendapatan rendah untuk keluar daripada kelompok kemiskinan dengan mengurangkan birokrasi untuk pinjaman pendidikan tinggi,memberi subsidi/elaun sara hidup kepada peminjam golongan berpendapatan rendah, memudahkan peminjam golongan berpendapatan rendah mendapat pekerjaan, dan sebagainya.” – Syah

“I have some concerns about the different impacts of free education on ethnic minorities, for whom it is more difficult to enter public universities. I would like us to switch to a more needs-based admission. The minorities who are not earning as much are also the same people who cannot make it into IPTA. They have to fork out more money to get onto the same level of education (in private institutions)." – Emma

“My wish is that we can move away from the current expensive loan system that can be very penalising and pinching on people. Policymakers and political parties ought to reevaluate how the loan system works, and make sure there are sufficient job opportunities and security. Those are their responsibilities.” – Shima

“The government and taxpayers are already paying for a significant proportion of PTPTN borrowers’ education by paying the interest rate gap between PTPTN’s subsidised rate to their borrowers and the market rate PTPTN is charged by institutional lenders. It makes more sense to do away with this rather roundabout approach of subsidising a person’s education – replacing interest subsidies paid to financial institutions in favour of an outright tuition subsidy and cost of living stipend for B40 school leavers. It would also be beneficial for the loan administrator (i.e. PTPTN) as it provides some relief from managing a chunk of borrowers most likely to default on repayments. How much will this cost? Our rough estimate puts the direct subsidy cost at 1.3-2 times more than the current regime of subsidising student loans and covering default rates, conservatively assuming that all the courses financed are for degree programs and with a relatively high ratio of IPTS students.” – Indebted Generation Part 3

Conclusion

Our interviews and focus groups have provided a glimpse into the lived experience of borrowers, and how their lives are affected by student loans. Their stories, coupled with our study last year, demonstrate that there is indeed a public appetite to reform Malaysia’s higher education financing policies. With the 15th general election (GE15) looming, our advice to parties and politicians seeking to get elected is that they should take into account the plight and voices of these student loan borrowers and reignite the public conversation on student loan reforms.

Throughout this research series, we have repeatedly emphasised that B40 borrowers are disproportionately affected by student loan debt as compared to those from other income groups. In bringing the series to a close by presenting the real-life challenges that they face, we hope to convince both policymakers and the public on the need for progressive changes to bring about more affordable, accessible and equitable higher education for all Malaysians.

Email us your views or suggestions at editorial@centre.my

The Centre is a centrist think tank driven by research and advocacy of progressive and pragmatic policy ideas. We are a not-for-profit and a mostly remote working organisation.