Research and advocacy of progressive and pragmatic policy ideas.

The Cost of Higher Education in Malaysia

Current issues in higher education financing in Malaysia.

By Editorial Team26 November 2019

Baca Versi BM

- In the New Straits Times earlier this year, the Director-General of the Department of Higher Education, Ministry of Education stated that approximately 1.3 million Malaysian youths are currently enrolled in tertiary education in the country. Enrolment rates at tertiary higher education institutions (HEIs) today is at a rate of 44% of those between 17 and 23, compared to 14% in the 1970s and 80s.

- In meeting the increased demand for post-secondary qualifications, Malaysia has seen a growth of both public and private HEIs in the past twenty years. Currently, as of 31 October 2019, there were 446 private HEIs, 54 of which are private universities including branch campuses, 10 foreign university campuses, 37 university colleges and 345 colleges. For public institutions, the ministry lists 20 universities (not including branch campuses), 36 polytechnics and 103 community colleges.

How Much Does It Cost To Get an Undergraduate Degree in Malaysia?

- A key differentiating factor between Malaysian public and private HEIs is of course, cost. Public HEI costs are heavily subsidised by the government (see The Edge Malaysia Infographic, Issue 1294), where as private HEI students typically bear the full cost.

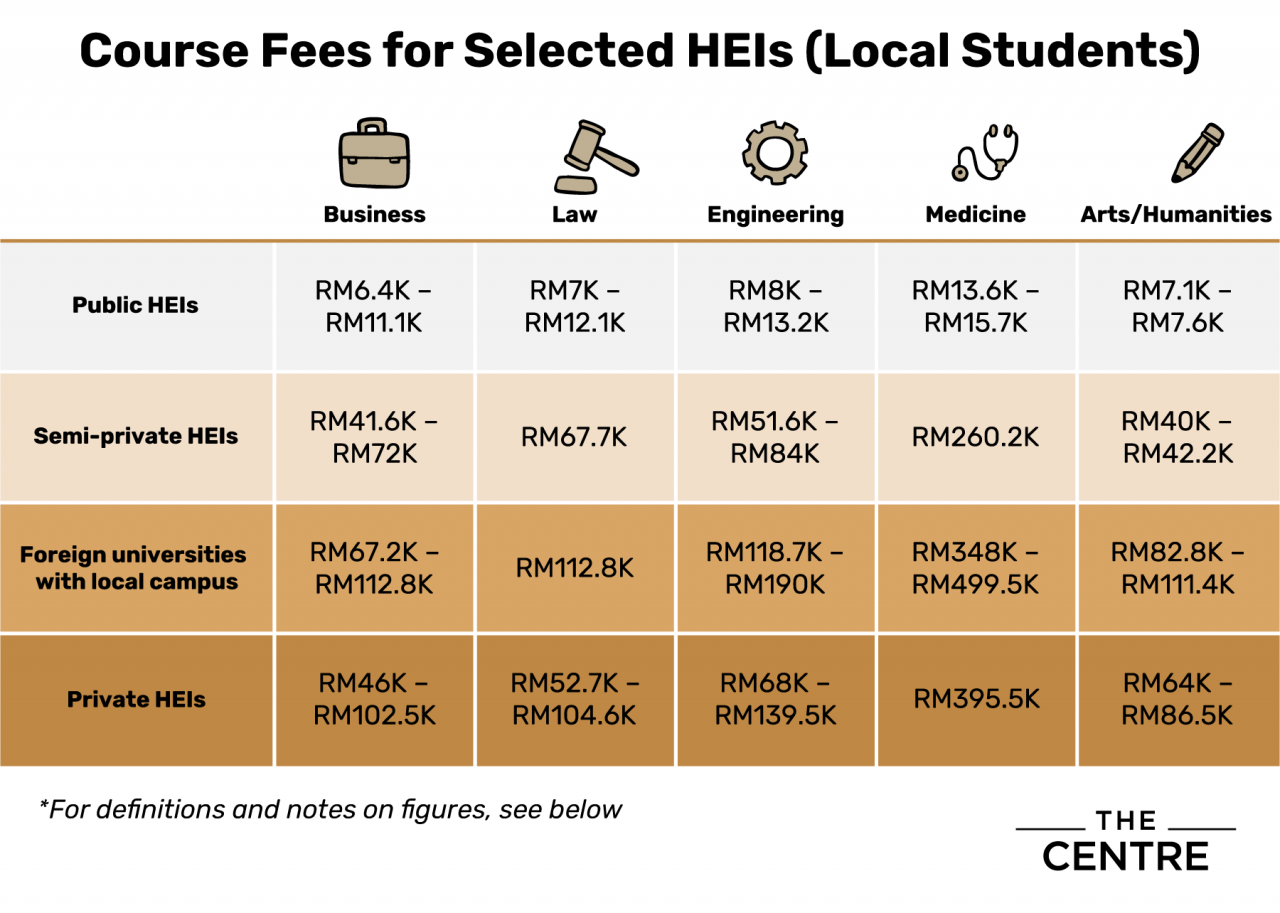

- The table below summarises a range of fees for different types of undergraduate (Bachelor degree) courses from selected Malaysian universities for local students, categorised by broad subject areas and the type of HEI. On top of the fees charged, students also need to pay for travel costs, living expenses as well as learning materials.

Public HEIs include UM, UUM, UKM, UMP, UTem and Unimas. Semi-private HEIs include Uniten, Multimedia University and UTAR. Foreign universities with Malaysian campuses include Nottingham, Monash and Manipal Melaka. Private HEIs include Taylor’s University and HELP University.

Side Note: Researching Education Costs

Course fee information provided on university websites were not standardised or straightforward. Different institutions would present information in different ways – for instance some would provide annual fees while others would provide semesterised information. A small number of universities did not provide fee information on their website. This made direct comparisons rather tricky. We call for standardised and consistent information on education costs.

Where possible we contacted the institutions (both public and private) via email and / or phone to verify information on the website. Some were very helpful but in other cases, our emails were not responded to and our phone calls were passed on to different departments but ultimately did not obtain the information we sought.

The table above presents a range of fees based on published information, rounded up or down to the nearest hundred ringgit. There may still be differences with individual experiences, as we are aware that the published costs might have changed, or individual circumstances such as the need for additional preparatory courses may affect the fees.

Sources of Funding

- The Ministry of Education’s Laporan Kajian Pengesanan Graduan surveys graduates from Malaysian HEIs annually. In the latest report, 45.5% of graduates from Malaysian HEIs in 2017 surveyed obtained funding from the National Higher Education Fund or PTPTN, while 32.7% are self-funded, which may include personal bank loans. A further 7.5% obtain assistance from MARA, although the data does not state whether these are loans or scholarships. (Similar percentages have been reported in previous years).

- The remainder of students obtain scholarships or receive some form of financial aid from other sources. We summarise popular sources of higher education funding below, focusing mainly on students studying in Malaysia although some sources also offer funding opportunities for those studying abroad.

Self-Funding

- Self-funding typically refers to parental or family support for higher education. Parents or family members would have saved up over the lifetime of the student to fund their child’s education. PTPTN has launched a tertiary education savings called Skim Simpanan Pendidikan Nasional (SSPN-i) to encourage individuals and parents to save for tertiary education opportunities for themselves or their children.

- Another source of funds is EPF savings – students can fund their education at approved local or overseas HEIs via their parents’ or their own EPF Account 2. (Funds from EPF can also be used to pay off existing loans). From 2007 up till March 2016, a total of 583,150 applications of Education Withdrawal Scheme was approved with the disbursement of RM2,942 billion, funding 239,922 diploma and 299,194 degree courses.

Part-Time Work

It is increasingly common for full-time students to supplement their income by working part time. This may be to cover for shortfall in funding to pay for courses, to cover living costs and other incidentals, to supplement existing income or to get ahead in saving to pay off their study loans. A HSBC report on higher education found that on average, Malaysian students spend 3.4 hours a day in paid employment.

Study Loans

- Students may also apply for study loans, which may be able to either fund the entirety of their studies, or to offset the costs of self-funding.

- The most popular source of study loans is the PTPTN loan. The successful applicant is given a minimum of 50 per cent to a maximum of 100 per cent loan as per the funding list on the PTPTN website.

- Government agencies such as MARA, as well as a number of private organizations, financial institutions and cooperatives also offer loans, subject to meeting particular criteria and may or may not charge rates of interest on the loan.

Scholarships

- Students who are academically excellent may be able to secure scholarships or bursaries from government organizations (e.g. the Public Services Department, or JPA), the private sector as well as the university where they are studying. Typically, such scholarships require the student to serve their funder for a period of time after graduation, although this is not always the case.

- A list of available scholarships – often updated from time to time – can be found at websites such as (but not limited to) Senarai Biasiswa Terkini, Afterschool.my and Eduadvisor. The amount of the scholarships vary, and may be a fixed amount (e.g. RM10,000 per year) or may cover the full costs of study.

Other Financial Aid

- Qualifying students may apply for / receive financial aid provided by state level agencies. Examples include:

- the Federal Territory Islamic Religious Council (MAIWP) with the higher education zakat scheme for the poor in the Federal Territories;

- State trusts such as Yayasan Selangor, Yayasan Sabah and Yayasan Terengganu. These trusts may also offer scholarships and / or loans.

Crowdfunding

- With the popularity of crowdsourcing and crowdfunding, students can now seek help to fund their studies via raising finance from a number of people, each of whom donate small amounts.

- While not exclusively for tertiary education, Skolafund.com is one such platform in Malaysia where students who require financial assistance are matched with those who are willing to provide them with the necessary funding.

Impact of Higher Education Costs on Graduates

- The table showcased earlier in the article depicts typical undergraduate course fees at a selection of Malaysian HEIs. In addition to fees, other related costs still have to be borne by the students themselves or their families, regardless of whether they are enrolled at public or private institutions.

- While general education debt is not as widely debated in Malaysia compared to in the United States, the increasing number of students taking loans does mean that servicing education debt is becoming part and parcel of the monthly living costs of graduates today. The 2018 AKPK survey on Financial Behaviour and State of Financial Well Being of Malaysian Working Adults ranks education loans as one of the top 5 loan burdens of working adults, with it being in the top two in the 20-29 year old category.

PTPTN Funding and Student Debt

- Based on the annual Laporan Kajian Pengesanan Graduan, in the past few years, the largest education loan provider for Malaysian students at local HEIs has been PTPTN. Funding is available for students at both private and public institutions.

- Students are expected to begin paying after 12 months following graduation, although earlier payment is encouraged. (Students who achieve a first class honours degree can apply for exemption from repaying the loan).

- The ability to repay the PTPTN loan differs from student to student, with some saying it is burdensome while others find it less so. Of course, this depends on a number of different factors, such as starting graduate salary, or other financial burdens the graduate may already be facing.

- Low repayment rates of PTPTN loans has been a major concern of the fund, especially as the increasing lag between loan disbursement and amounts repaid continues to widen. Up to 2015, the annual percentage of loans collected hovered around the 50% mark, and as of 2018, PTPTN are currently owed circa RM39 billion by borrowers.

- A number of studies have attempted to unpack the seeming reluctance among borrowers to repay their PTPTN loans.

- A 2012 survey by UiTM academics suggested that graduates prioritised other loans over their PTPTN owings, ranking it as only the fifth important monthly expenditure , after living expenses, servicing their car loans, savings and sending money to their parents.

- A PTPTN study quoted in a Penang Institute paper on the sustainability of PTPTN financing argued that high living costs and insufficient income were the two main factors influencing inability to pay.

- Work by Lim et al (2014) argues that we cannot ignore the state of the graduate labour market when evaluating repayments of a student loan scheme like PTPTN.

- The Minister of Education, Dr. Maszlee Malik, recently announced that the cabinet will soon decide on improvements to the scheme, including a new repayment mechanism. This is crucial in ensuring the financial sustainability of the fund.

Some questions from fans of policy and ordinary citizens:

To what extent are PTPTN’s loan collection problems just an issue of inefficient loan collection mechanism?

How do economic factors, such as low graduate starting pay, high costs of living and graduate unemployment compound problems of education loan repayment?

Email us your views or suggestions at editorial@centre.my.

The Centre is a centrist think tank driven by research and advocacy of progressive and pragmatic policy ideas. We are a not-for-profit and a mostly remote working organisation.