Research and advocacy of progressive and pragmatic policy ideas.

Indebted Generation, Part 1

The Quandary of Student Debt in Malaysia

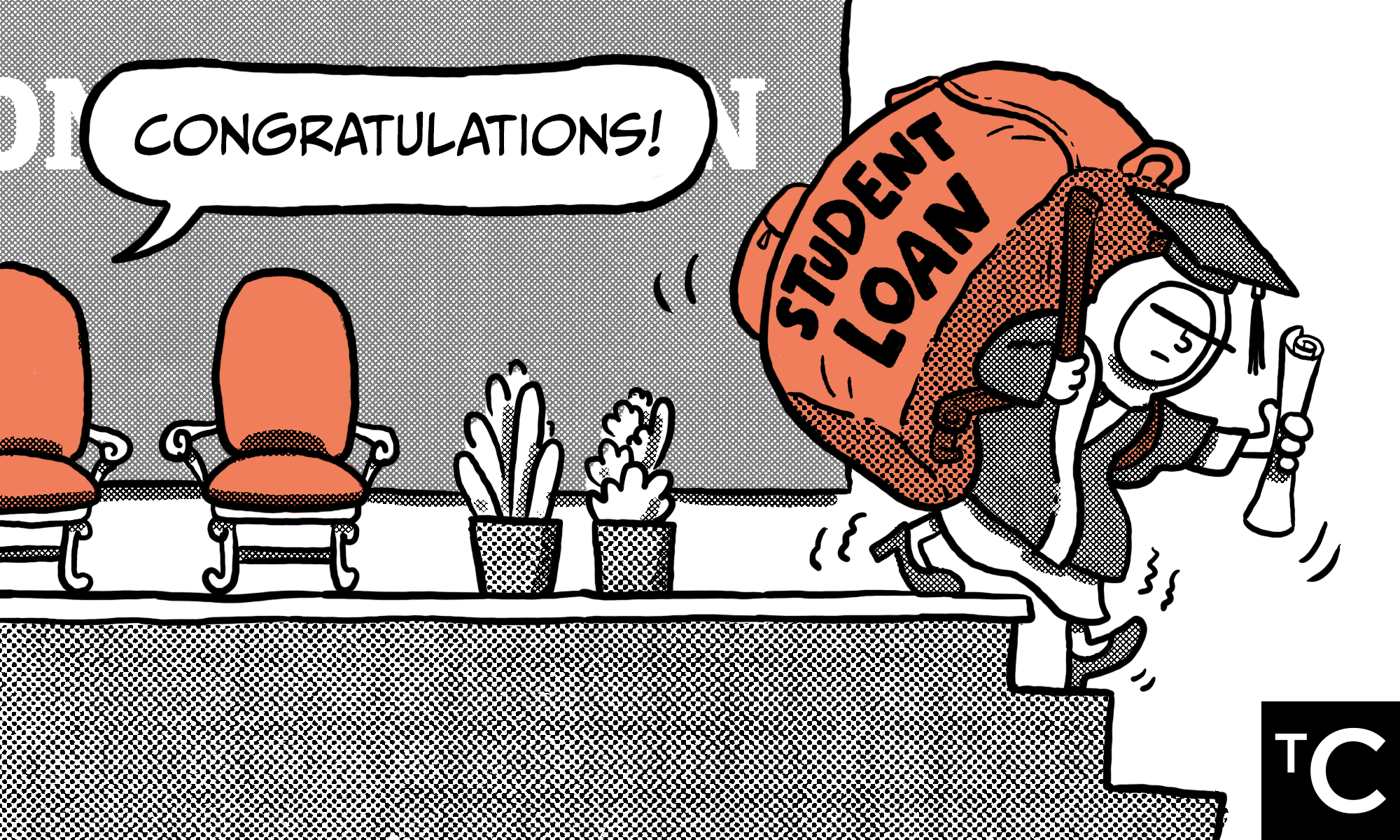

For a generation of young Malaysians, higher education is financed mainly through student loans. Should this approach continue? This research series examines this vital issue and explores ways forward.

By Ooi Kok Hin20 May 2021

Baca Versi BM

How do Malaysians pay for higher education? For a generation of young people, the answer is and has been student loans.

Student debt is both common and unique among the generation who enrolled in higher education after the new millenium. It is common due to the pervasive take-up of tertiary education loans issued by the National Higher Education Fund Corporation (PTPTN), the statutory body created to provide low-cost higher education financing. According to a 2018 Agensi Kaunseling dan Pengurusan Kredit (AKPK) report, student debt is the second most common debt among youth aged 20-29 years old.

At the same time, student debt is also unique for a generation of Malaysians. Unlike previous generations, the current young cohort has a significant debt burden even before entering the workforce. We estimate that on average, students enrolling in a local public university or a local private university today will accumulate student debt of RM26,600 and RM56,120 respectively for a four-year degree. 1

The popularisation of students loans is partially driven by expansions in the type and length of courses covered as well as the number of qualifying private higher education institutions. Nevertheless, the expansion of student debt is occurring together with what appears to be diminishing returns to higher education. A recent Department of Statistics report quoted the Chief Statistician as saying that "new degree graduates recorded a decrease in monthly income where the majority of them earned between RM1,001 and RM1,500 in 2020 compared to RM2,001-RM2,500 in 2019.”

COVID-19 certainly plays a major role here but even before the pandemic, job-seeking graduates faced uncertain employment prospects, labour market mismatch and stagnant wages. Today, the promise of social mobility through higher education is less secure compared to decades past when graduates were scarce.

Nearly two years ago, we published a primer on the cost of higher education in Malaysia which drew a broad picture of higher education fees and means of financing. This time, we examine Malaysia’s main national policy plank in financing higher education, i.e. student loans, in order to address questions about this policy’s long-term sustainability and relevance. But first, a look at the policy’s history.

1 Per PTPTN’s borrowing schedule, the amount is obtained by calculating the full loan amount for a four-year first degree course based on annual qualified disbursements per IPTA/IPTS student.

Higher education (and student loans) for all

In the early 1980s, two-thirds of students enrolled in Malaysian public universities (only five existed then) were funded by government scholarships granted by either the Public Service Department (JPA) or by a statutory body.2 A small number of student loans was offered by government agencies such as JPA and Majlis Amanah Rakyat (MARA).3

The shift to student loans as the primary means to fund higher education began in the 1990s, driven by the aim to rapidly increase higher education enrollment and produce an educated workforce. The policy is borne out of the Malaysia Incorporated Policy, initiated by then Prime Minister Tun Dr. Mahathir Mohamad to reduce reliance on state resources, boost the role of private markets while promoting the economic advancement of Bumiputeras.4

Two broadly related changes occured at the time – corporatization of public universities5 and rapid expansion of private higher education institutions.6 These changes created more student places in higher education, but it also increased the cost. This became a politically heated issue, particularly the challenge of Bumiputera students’ limited capacity to pay for higher tuition fees.7

The idea of student loans as a policy solution was thus introduced, leading to the creation of statutory body PTPTN in 1997. In its early years, PTPTN provided student loans to 11 public universities (IPTA) and a few private universities (IPTS) owned by government-linked companies.8 There was a great demand for PTPTN’s student loans, due to the relative ease of approval and low interest rate.

In the early 2000s, loan eligibility was extended to students from more private higher education institutions, including local branch campuses of foreign universities. On top of providing loans to students from a greater number of institutions, PTPTN also started to provide loans for diplomas and master’s degrees.

Figure 1 shows the surge in the number of PTPTN loans approved annually while Figure 2 shows the rise in the total amount of PTPTN loans approved annually. Notably, the monetary amount of PTPTN loans approved for study in private institutions surpassed the amount of loans approved for study in public institutions since 2007 (see Figure 2), though the number of loans approved, or number of borrowers, for public institutions remain higher than for private institutions (see Figure 1).

Figure 1: Number of PTPTN Loans Approved, 2000-2018

Source: PTPTN annual reports, Info PTPTN booklet, and “The Sustainability of the PTPTN Loan Scheme” report by Penang Institute.

Figure 2: Total Amount of PTPTN Loans Approved, 2000-2018

Source: PTPTN annual reports, Info PTPTN booklet, and “The Sustainability of the PTPTN Loan Scheme” report by Penang Institute.

2 Mehmet, O., Hoong, Y.Y. “An empirical evaluation of government scholarship policy in Malaysia,” Higher Education 14, 197–210, 1985.

3 JPA ceased to offer student loans a few years after PTPTN was formed to avoid overlapping functions. Their allocation was transferred to PTPTN, which assumed the role of the main student loan provider.

4 See the “Introduction” in the Privatization Master Plan 1991. See also Khoo Boo Teik, Beyond Mahathir: Malaysian Politics and its Discontents. Zed Books, 2003.

5 Corporatized universities are expected to raise and diversify their sources of funding through a variety of revenue-generating activities such as venturing into business, offering more commercially-viable programs, and increasing tuition fees to reduce reliance on state allocation. For details, see: Molly Lee (1998), "Corporatization and privatization of Malaysian higher education." International Higher Education, 10.

6 The establishment of private universities, the upgrading of private colleges into university colleges and universities, and the invitation to foreign universities to set up branch campuses in Malaysia was made possible by a slew of new laws, policies, and bodies to facilitate the expansion of the higher education industry in the 1990s.

7 During UMNO General Assemblies in the mid-1990s, delegates spoke out against the low enrollment of Bumiputera students in IPTS. In addition, they warned that if public universities were corporatized, Bumiputera students would be affected in the event of tuition hike.

8 Due to very low Bumiputera enrolment in IPTS, PTPTN loans for IPTS were only provided for Bumiputera students in its first few years of operation.

Unintended consequences and burdens

PTPTN was created to enable greater access to higher education, particularly for youth in low-to-mid income households. In terms of loan disbursements, PTPTN appears to have stuck close to this mission. Relatively recent PTPTN records indicate that 66% of all borrowers are Bumiputera and 55% of all borrowers come from B40 households (see Figure 3). The loans are almost evenly split between those who borrow to finance degree programs versus diploma programs.

Figure 3: Demographics of PTPTN borrowers, 2014-2018

However, two unintended and major problems have become increasingly clear since PTPTN’s inception. The first problem is the unrealised assumption of upward social mobility.

(i) The returns from tertiary education

The basic premise of student loans is borrowers’ ability to repay, thanks to higher earning potential from obtaining tertiary qualifications. At a macro level, this assumption appears to hold largely true; tertiary education still generates higher median wages overall compared to secondary and primary education as shown in Figure 4.

Figure 4: Median Salary and Wages By Education Level

Source: Salaries & Wages Survey Report, 2014-2019, Department of Statistics, Malaysia.

However, if we look beneath these high-level numbers, we can safely conclude that the returns from tertiary education is not evenly distributed. The impact of labour mismatch and wage stagnation can be seen from PTPTN borrowers’ earnings data and unemployment data.

The 2018 Malaysia’s Graduate Tracer Study (SKPG) showed that almost 60% of graduates were or remained unemployed a year after graduation. Of these unemployed graduates, half of them have student loans to service.9 Of those employed, a 2019 survey on borrowers commissioned by PTPTN found that more than one-third of their respondents earn below RM2,000 a month.10

Choice of course or program doesn’t seem to explain why some borrowers fare worse than others. A survey done by Parti Keadilan Rakyat (PKR) in 201311 discovered that slightly more than half of the 1,053 respondents across different fields of study earn below RM2,000. Despite the government’s encouragement of science and technology courses over humanities courses12, the survey found that a majority felt burdened by their student debt regardless of their field of study.

More seriously still, the combination of unmet higher earnings potential and the burden of student debt seems to impact B40 borrowers disproportionately. PTPTN’s own study revealed that 97% of the loan defaulters surveyed were from the B40 income group.13 Defaulters cited high debt obligations and low income as the primary reasons for their non-payment; less than 10% attributed their lack of payment to an act of protest or lax debt collection by PTPTN. Evidently, social mobility for B40 student borrowers is by no means assured by attaining tertiary qualifications.

Apart from social mobility, there is also the question of equitability. Typically, borrowers are expected to pay off their debt in 20 years or less but PTPTN allows borrowers to negotiate loan restructuring and stretch the repayment period until the borrower reaches 60 years of age.

If borrowers defer their payments or restructure their loans (e.g. pay a lower monthly instalment for a longer period of time), they will end up paying more interest than those who earn more and who can settle their loan quicker. A prolonged period of repayment means that lower-income borrowers are not only paying more interest, they’re also in debt for an extended period of their adulthood.

Given that the returns on higher education are less secure today, and appear to impact those from the B40 disproportionately, one can reasonably ask whether PTPTN loans as a policy instrument for higher education funding is ripe for a significant rethink.

9 Laporan Kajian Pengesanan Graduan 2018, Kementerian Pendidikan Tinggi Malaysia. For the first quarter of 2021, PTPTN allows borrowers who are facing financial difficulties due to Covid-19 pandemic to request for deferring payment.11 JPA ceased to offer student loans a few years after PTPTN was formed to avoid overlapping functions. Their allocation was transferred to PTPTN, which assumed the role of the main student loan provider.

10 Wan Saiful Wan Jan, “Malaysia’s Student Loan Company: Tackling the PTPTN Time Bomb,” ISEAS-Yusof Ishak Institute, April 2020.

11 The survey was part of an initiative and campaign calling for free education at public universities and as such, the sampling methodology may disproportionately reflect the experience of students and graduates from public universities.

12 The government’s encouragement of science & technology courses is reflected in policy: among the first batches of PTPTN borrowers, those who took science and technology courses were charged a 2% interest rate while those who took arts and humanities courses were charged a 4% interest rate.

13 Wan Saiful Wan Jan, Malaysia’s Student Loan Company: Tackling the PTPTN Time Bomb, ISEAS-Yusof Ishak Institute, April 2020.

(ii) The sustainability of PTPTN itself

The more well-known issue regarding PTPTN’s financial sustainability is its loan collection tribulations, which have been lower than projected. The spectre of ‘immoral’ delinquent debtors is often invoked in connection with this, but this claim is only partially true.

Apart from some exceptions, most PTPTN borrowers are required to start paying off their student loans 12 months after they graduate from their program of study. Out of approximately 3 million borrowers, about 1.9 million borrowers are supposed to be paying or have paid off their loans at this juncture.

Figure 5 shows the loan repayment amount and the shortfall faced by PTPTN. In terms of the numbers of borrowers, 81% of the 1.9 million borrowers who are supposed to have started paying back their loans have either completed their payment, are paying consistently, or were/are paying inconsistently; overall loans collected from this 1.9 million borrowers amount to RM14.3 billion.14 An admittedly large minority, 19% of borrowers, fail to make any payment at all to a total of RM2.8 billion.

Figure 5: PTPTN Loan Collection and Shortfall, as of 2018

Source: PTPTN annual report 2018.

As mentioned in the previous section however, PTPTN’s own survey provided evidence that almost all of the loan defaulters are from B40 households facing financial problems.15 The same survey found that 74% of defaulters have no regular income or earned below RM2,000 after graduation compared to 52% of borrowers.16 Therefore, the larger narrative and rhetoric depicting delinquent borrowers as “shameless” or “irresponsible” individuals is not entirely accurate. The narrative of lax debt collection is also evidently unfounded – repayments are difficult to enforce if there is no spare income.

Repayment is an important, but the less discussed yet arguably more serious issue with respect to PTPTN’s financial sustainability is its financial structure. For the first five years of its operations, PTPTN received direct government grants to lend on to student borrowers. After these initial years however, PTPTN has relied on borrowing from the financial markets, via loans as well as sukuk issuance, to fund its lending operations (see Figure 6).17 As of the end of 2018, PTPTN had government-guaranteed borrowings of nearly RM40 billion and this amount is projected to rise to RM76 billion in twenty years.

Figure 6: Debts Accumulated by PTPTN, as at end 201818

The significant interest rate gap between PTPTN’s borrowings and its lending makes for a clearly unsustainable model. PTPTN has openly acknowledged this fact with its Chairman saying “PTPTN borrows from the financial market at, on average, 4 to 5% interest rate, while it charges borrowers just 1%. The difference has been compounding year-on-year for twenty years, contributing significantly to PTPTN’s mountain of debt.”19

PTPTN’s borrowings are guaranteed by the government and given the size of the outstanding debts, it appears likely that the government and taxpayers would have to pay for its debt and interest payments for decades to come.

In 2018 alone, PTPTN received RM 1.94 billion from the government, of which the large sum of RM1.74 billion went towards servicing these debts. The statutory body estimates that it is currently responsible for almost RM40 billion in debt and another RM13 billion in interest. Figure 7 illustrates PTPTN’s interest payments to financial institutions from 2011 to 2018, which come up to an average of 73% of its annual expenditure.

Figure 7: PTPTN Interest Payments vs. Total Expenses, 2011 – 2018

Source: PTPTN annual reports and “The Sustainability of the PTPTN Loan Scheme” report by Penang Institute.

Given the sheer amounts involved, which continue to compound year on year, one can reasonably wonder whether the funding injections to service these institutional borrowings is really achieving the original purpose of PTPTN, or whether it is a roundabout way of financing national higher education via taxation.

14 Inconsistent payers are those who make payments and subsequently stop before settling the debt, or those who pay regularly but below the stipulated amount.

15 Wan Saiful Wan Jan, Malaysia’s Student Loan Company: Tackling the PTPTN Time Bomb, ISEAS-Yusof Ishak Institute, April 2020.

16 Ibid.

17 Ibid.

18 Although they have different maturation periods, we aggregated the sum of the various sukuk purchased by each respective financial institution for illustration purposes above. PTPTN’s sukuk is unconditionally guaranteed by the Government of Malaysia which protects against capital loss.

19 Wan Saiful Wan Jan, Malaysia’s Student Loan Company: Tackling the PTPTN Time Bomb, ISEAS-Yusof Ishak Institute, April 2020.

The wider ramifications of student debt as policy instrument

The need to reform higher education financing has been acknowledged by policymakers and PTPTN in various ways. A senior PTPTN officer remarked to this researcher that they are concerned about graduate unemployment and even the possibility of pushing the youth into bankruptcy. “We are not just worried about money, but also graduates who don’t have a job but have a lot of debt. For example, if someone takes a degree at IPTS, he will owe us about RM 60,000. Just imagine if you take a course that doesn’t result in a job. Suddenly you have a debt of RM60,000. PTPTN can even bankrupt people. So, we don’t want people to have the wrong debt, especially young people.”20

“We are not just worried about money, but also graduates who don’t have a job but have a lot of debt. For example, if someone takes a degree at IPTS, he will owe us about RM 60,000. Just imagine if you take a course that doesn’t result in a job. Suddenly you have a debt of RM60,000. PTPTN can even bankrupt people. So, we don’t want people to have the wrong debt, especially young people.”

Since 2004, the student loan agency has been promoting the SSPN savings scheme, with support from the government. Scheme savers qualify for up to RM8,000 in tax relief. Low-income savers also qualify for matching grants up to a maximum of RM10,000.

More changes may be afoot. PTPTN recently indicated that a new strategic plan will be launched in June 2021 to improve their functions and remain viable. While we look forward to this announcement, we also argue that the problem goes beyond the viability of PTPTN, and that it goes to the question of the role of higher education and a rethink of funding models.

Higher education enrollment in Malaysia is often lauded as one of Malaysia’s success stories. Last year, the Department of Statistics reported that there are approximately 5.3 million graduates.21 Student enrolment in public and private higher education institutions in 2010 was six times the number in 1990.22

Yet, as stated above, the returns from higher education are not guaranteed, particularly it seems for B40 PTPTN borrowers. The massification of higher education – both in terms of the number of student enrollment and the number of higher education institutions in the country – is part of the issue.

Since the late 1990s, PTPTN has functioned as the lynchpin of the higher education ecosystem by providing low-rate, easily obtainable loans. Private colleges in particular rely heavily on student loans, and colleges of varying quality have mushroomed over the years due to the ease of loan approval and the lack of quality regulation.23 Better regulations will hopefully reduce the number of substandard colleges but Malaysia still needs to grapple with the following core questions: firstly, what are the real returns to different types of education and secondly, how can higher or continuing education be financed effectively and equitably.

In Part 2 of this research series, we will outline the trade-offs of different policy proposals to reform student debt and higher education financing in Malaysia. Stay tuned.

20 Author’s interview with a senior PTPTN bureaucrat, 17 February 2020.

21 “Graduates Statistics 2019,” Department of Statistics, Malaysia. Released on 16 July 2020.

22 Malaysia Education Blueprint 2015-2025 (Higher Education). Ministry of Education Malaysia.

23 The Ministry of Higher Education has been making efforts to enforce standards. The Malaysian Qualifications Agency (MQA) was established in 2007 and the ministry plans to make it compulsory for all IPTS to go through the Malaysian Quality Evaluation System for Private Colleges (MyQuest) and Rating System for Malaysian Education (SETARA) rating systems.

The Centre is a centrist think tank driven by research and advocacy of progressive and pragmatic policy ideas. We are a not-for-profit and a mostly remote working organisation.