Research and advocacy of progressive and pragmatic policy ideas.

Room for Rent, Part 3

Survey of renters’ experiences and preferences

What do renters want? What factors are likely to encourage long-term renting? We conclude our research series with a survey probing renting norms, insecurities that renters face, and their future housing aspirations.

By Fikri Fisal, Ooi Kok Hin & Nelleita Omar14 September 2022

Baca Versi BM

In December 2021, The Centre started a research series to explore the experiences, challenges and aspirations of renter-households.

In Part 1 of this research series, we highlighted the prevalence of renting among B40 and M40 households in the Klang Valley region. Despite Malaysia’s relatively high home ownership rate at 76.9% (2019), only 45% and 53% of B40 households in Kuala Lumpur and Selangor, respectively, own their homes.1 Among M40 households in Kuala Lumpur and Selangor, 51% and 65% respectively, own their homes.2 The sizable numbers of such “hidden” renter-households, particularly among lower income households in urban areas, necessitates greater policy attention to their plight and anxieties.

In Part 2, based on a study of global practices, we highlighted three main approaches that can be taken by the government to improve the rental market. The three policy tenets that we recommend, based on pro-renting policies implemented in other countries, are strengthening tenant protection, incentivising greater supply of rental units and adopting rent stabilisation measures.

In this final instalment, we present findings from our survey aimed at gathering and recording renters’ experiences, insecurities and housing aspirations. While a small majority of our survey respondents wish to own their own homes, there is a significant portion who want to either rent long-term or remain undecided.

Location emerges as a crucial factor in a respondent’s decision to rent or buy a house. Even amongst low-income groups, location appears as important as affordability-related factors such as long-term job security, ability to pay the down payment and housing loan eligibility. This finding raises the question of whether the government’s strategy to facilitate home ownership via easy financing schemes, as well as construction of low and medium-cost housing in less strategic locations, needs to be supplemented with measures that increase supply of affordable rental units in targeted locations.

These are some key findings, among many others, from our survey which is further detailed below.

About the survey

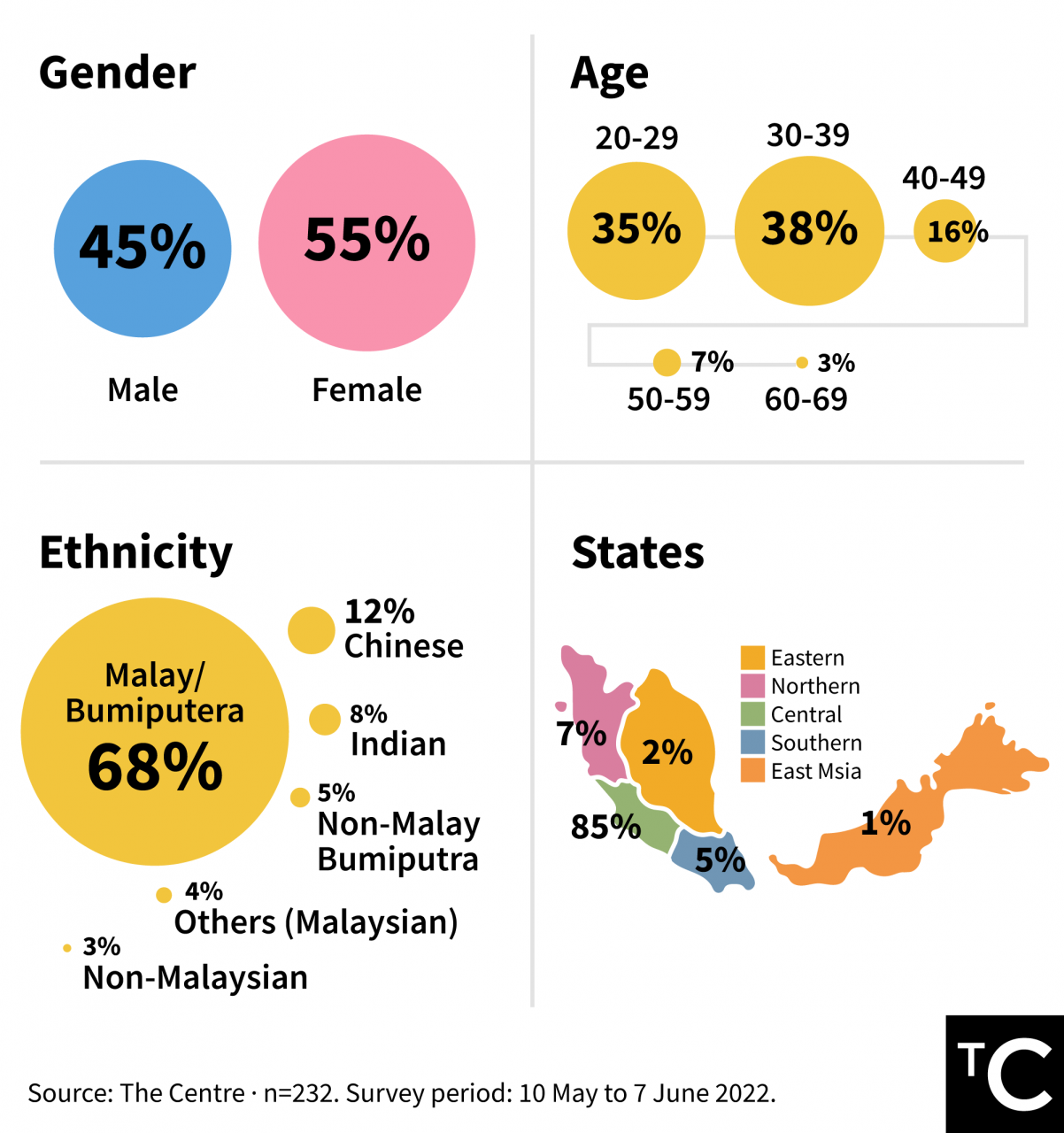

The study was conducted online using a convenience sampling method. The questionnaire was written in Malay, English and Mandarin and was made available from 10 May to 7 June 2022.

Owing to resource limitations, responses to this study do not represent a nationally stratified sample. Hence, we advise readers to interpret the results with this limitation in mind.Our intention in conducting the survey was to develop an initial picture of Malaysian renters’ situation and aspirations, which are currently unavailable due to the serious lack of data on the rental market.

A total of 232 respondents comprising 173 current renters and 59 former renters completed the survey. Our survey responses are skewed towards Klang Valley residents (83%), and towards young Malaysians below 40 years old (74%).

Malay Bumiputera forms the majority of respondents (68%), followed by Chinese (12%), Indians (8%), Non-Malay Bumiputera (5%), Others (4%), and Non-Malaysians (3%).

Households earning RM5,000 or less a month make up about half (51%) of the respondents – a category which is considered below the B40 income level when adjusted to Kuala Lumpur and Selangor thresholds. This is followed by households earning between RM5,001-RM11,000 (29%), RM11,001-RM15,000 (10%) and more than RM15,000 (11%).

The respondents are quite evenly distributed in terms of sex – female (55%) and male (45%). In terms of relationship status, half of respondents are married (50%), followed by single (45%), divorced (4%) and widowed (1%).

Demographics of Survey Respondents

Why rent? Answers differ by income

The survey reveals that location is the top factor for a respondent in their decision to rent a house. Just over half (53%) of respondents say that they chose to rent their home due to its strategic location and connectivity – close to the workplace, public transportation system, or family members.

A breakdown of responses according to income level reveals that while location is a major factor across all groups, it varies in priority depending on income. Among households earning less than RM2,700 a month, the top three reasons to rent are ineligibility to qualify for a housing loan (21%), strategic location (20%) and unaffordable downpayment (19%). For households earning between RM2,700 and RM5,000, their top three reasons are unaffordable downpayment (19%), strategic location (18%), and uncertain job security (15%). For these two income groups, the decision to rent is a combination of both affordability factors and location.

In contrast to their lower income peers, respondents from upper income groups tend to prioritise flexibility alongside location. Predictably, financial factors are ranked lower in their decision to rent a house.

Among households earning between RM5,001 and RM11,000, the top three reasons to rent are strategic location (22%), flexibility (19%) and preference to not acquire long-term debt (15%). For households earning between RM11,001 and RM15,000, the top two reasons are strategic location (28%), flexibility (22%) while tied at third place are down payment unaffordability (12%) and neighbourhood amenities (12%).

For respondents with household income exceeding RM15,000, the top three reasons are strategic location (24%), flexibility (22%) and preference to not acquire long-term debt (17%).

Figure 2: Top 3 Reasons Why Respondents Rent

Cost burden of renting

Cost-burdened renters are defined as those who spend more than 30 percent of their incomes on rent and utilities each month.3 Positively, many of the renters surveyed do not fall into that category. A large majority (84%) of our respondents pay 30% or less of their income on rent.

We observed that rent as a percentage of income decreases as income rises, and vice-versa. Although the number of renters who pay more than 30% of their income on rent is small, a large portion of them comprises low-income households. The majority of tenants who pay more than 30% of their income on rent – considered as cost-burdened renters – are households who earn RM5,000 or less a month. Most concerning is that among those earning less than RM2,700, 42% are cost-burdened (Figure 2).

Related to the theme of cost burden, a large majority of respondents (79%) say they have never missed paying their rent on time. Only 13% say they miss their rent payment one to two times a year while 7% miss it three to five times a year. A very small proportion 1% miss it more than five times a year.

A breakdown by income reveals, unsurprisingly, that low-income groups face greater difficulties in making their rent payments on time, particularly for those earning less than RM2,700 a month. 48% among this group reported missing their rent payment, which is two times higher than those earning between RM2,700 to RM5,000, and three times higher than those earning between RM5,001 to RM11,000.

A relatively high percentage of low-income respondents live with 5 or more co-residents. 38% of respondents who earn less than RM2,700 a month, and 32% of respondents who earn between RM2,700 and RM5,000 a month, live with 5 or more people in the same rented residence. In contrast, among respondents earning more than RM5,000 a month, the percentage falls to between 8% to 13%.

Experience with landlords

90% of survey respondents reported mostly positive experiences with their landlords, which were indicated by landlords giving fair treatment, taking responsibility over major repairs, or willing to accommodate requests regarding minor modifications or rental negotiations.

Most respondents to our survey also have not experienced unjust or harsh treatment by their landlords, namely getting evicted without valid reason, having security deposit deducted unfairly, being locked out of the unit, facing drastic rent increases, or being asked to pay for major repairs.

Slightly more than two-third of respondents (70%) reported that they have not, as far as they know, experienced discrimination in their rental application. For those that have experienced discrimination, ethnicity appears is the most frequent reason (perceived by the respondent) compared to other factors such as gender, occupation or nationality.

This is most prominent among Indian respondents with 61% (almost two out of every three Indian tenants) answering they have faced such discrimination before. Note also that Indians are the only group where respondents who have faced ethnic discrimination outnumber those that have never experienced discrimination.

Awareness of tenancy rights

Generally, our survey respondents demonstrate high awareness of their rights as tenants. 91% correctly answered that the landlord is responsible for servicing maintenance fees, quit rent and other property-related charges; 81% affirmed that a landlord may not enter the rented premise as they please; 76% thought that landlords have the right to reject a rental application.

Nonetheless, in some scenarios, respondents are more split. For example, 48% felt that the landlord is allowed to sell the property being rented by a tenant while 35% answered negatively. Currently, in the absence of a tenancy protection law, tenants in Malaysia must vacate the unit if/when the landlord sells the property.

32% answered that the landlord has the right to take a tenant’s security deposit for any reason while 59% answered that the landlord does not have this right. Until and unless there is a legislation regulating or prohibiting otherwise, landlords have the final say on deduction of their tenant’s security deposit.

A sizable 26% of respondents believed that landlords are entitled to evict tenants without a reason while the majority (65%) answered the contrary and 9% unsure. In Malaysia, landlords do have the ability to evict tenants but they are required under Section 7(2) of the Special Relief Act to obtain a court order before they can remove an existing tenant.

Home ownership remains an aspiration for many

Owning a home is still a long-term aspiration for nearly two-thirds (65%) of respondents. When broken down by income, the highest percentage of respondents who plan to buy a house come from households earning RM11,001-RM15,000 monthly (82%), followed by RM2,700-RM5,000 (68%), RM5,001-RM11,000 (64%), more than RM15,000 (62%) and less than RM2,700 (58%).

Curiously, a substantial 26% of respondents are undecided on whether to buy a house or not in the future. Nearly one out of three respondents in the lowest income group (households making less than RM 2,700 monthly) are unsure about their plan to buy a house, arguably due to it being a greater financial undertaking for them.

Although a majority of renters surveyed indicated that they plan to buy a house in the future, 68% say they plan to continue renting until they feel prepared to settle down in a particular location. Planning to rent until the right location for home ownership presents itself is the top reason across all income groups except the lowest income group who plans to continue renting more for affordability and job security reasons.

23% of respondents – not a small number – plan to rent long-term instead of buying a house. Interestingly, respondents appear to be more open to long-term renting as their income rises. Only 18% and 17% of respondents who earn less than RM2,700 and between RM2,700 and RM5,000 respectively say they plan to rent long-term. In contrast, the percentage of respondents who plan to rent long-term ranges and who earn more than RM5,000 a month ranges from 23% to 30%. Renting long-term rather than owning one’s home may be comparatively more attractive for higher-income earners rather than lower-income earners due to the range of rental units available in higher brackets as well as the range of other assets and investments for those with more capital.

What renters want: Preferences and policies

We asked respondents what factors would increase the likelihood of them renting long-term instead of buying a house to live in. Interestingly, the top two factors cited by respondents are ‘pull’ factors. 77% of respondents say they would consider renting long-term if there were more protective regulations for tenants such as anti-discrimination laws, safe guarantee of security deposits and clearly-defined tenant rights. 73% of respondents say they would consider long-term renting if there were more affordable renting programmes, for example more units of public rental housing, provision of rental subsidy or rent stabilisation measures.

The third most-cited factor, on the other hand, is a ‘push’ factor. 65% of respondents say they are more likely to rent if buying a property at their preferred location becomes too expensive. It is noteworthy that these three factors were cited as the topmost factors across all income groups.

We also asked respondents what policy ideas should be prioritised by the government to improve the rental market. Most respondents prioritise affordability-related schemes.

The top three policy actions chosen by the respondents are stabilisation of rental rates (51%), building of more public housing or social housing for rent (50%) and rental subsidy for B40 and M40 households (41%). Preventing discrimination in rental applications is also important, chosen by 38% of respondents.

Somewhat to our surprise, only 16% of respondents prioritise the creation of a third-party body to manage tenants’ security deposit, which is among the most contentious suggestions in the proposed Residential Tenancy Act by the Ministry of Housing and Local Government (KPKT).

Implications for policymakers

The key findings of this survey highlight several important points. Firstly, location plays a highly important role in one’s decision to buy or to continue renting a house. Numerous affordable housing schemes may have overlooked, or at least underestimated the importance of this consideration compared to affordability.

In terms of policy, affordability-centric diagnoses can overprescribe the expansion of easy access to financing to solve the housing predicament. If location matters – as underscored by this survey’s respondents – then more easy financing schemes alone will not be effective in increasing the take-up rate of newly-built houses. This could explain the initial low take-up rate of PR1MA homes which were largely built in remote and non-strategic locations as well as the general overhang in the ‘affordable’ housing price range in the housing market today.

Secondly, while home ownership is still a popular aspiration, there appears to be some appetite for long-term renting provided that certain policies and schemes are in place. Renting as an option to meet housing needs can grow in appeal if tenants receive greater protection particularly in terms of rental affordability, stability and security. Also important is to enact measures to curb discriminatory practices in rental application processes. The establishment of a character database which rates for trustworthiness and fairplay could discourage landlords from discriminating (and other bad behaviour) as well as incentivise renters to be dependable tenants.

Thirdly, attention must be directed towards alleviating cost-burdened renter households, which are largely made up of those earning below RM5,000 monthly. Perhaps owing to financial constraint, this group also appears to face relatively higher living density in their homes as many of them reside with at least 5 other co-residents. Greater policy attention must be oriented towards increasing the supply of affordable rental housing and designing them in accordance with decent urban liveability.

Finally, the rights of tenants as well as mechanisms to resolve landlord-tenant disputes need to be clearly spelled out in a comprehensive legislation. We recommend that such legislation i.e. the proposed Residential Tenancy Act will focus on clarifying existing ambiguities surrounding tenant rights to minimise landlord-tenant disputes, exploitation or discrimination. This is particularly true for two matters: whether a landlord can deduct or withhold security deposits for any reason, and safeguards for current tenants when a landlord chooses to sell the house which is being rented out. Elucidation of these rights will provide greater financial and tenure security for tenants.

Conclusion

This article concludes the three-part Room for Rent series. In part one, we began the series by outlining Malaysia’s longstanding, single-minded policy focus on home ownership as well as conducting a preliminary survey to explore housing modes and aspirations among Malaysians. In part two, we explored three key approaches that the government can emulate to empower the Malaysian rental market. In part three, we probe renters’ views and preferences to better understand renting norms, insecurities and perceptions among current and former tenants.

We believe that it is timely for policymakers to shift greater attention to renter-households and the rental market. Renter-households make up approximately half of B40 households in Klang Valley and they receive little policy attention. This is in contrast to the many government programmes which seek to boost home ownership. Pro-renting policies and home ownership policies is not a zero-sum question; both need to receive due consideration for as long as home ownership remains out of reach due to affordability reasons or renting remains the only feasible option for households who live in strategic, central locations.

It is our hope that this topic receives greater deliberation among policymakers, researchers and the public alike. While the proposed Residential Tenancy Act is an encouraging step, the lack of clarity and certainty with regards to its contents and implementation timeline is disconcerting at a time when local rental demand is surging and other countries are reporting record-breaking rent hikes.

Therefore, we hope the government maintains its commitment to table this much-needed act as soon as possible, with appropriate consultations with stakeholders and policy experts, for the sake of many tenants who are facing a rising cost of living. The introduction of new policies and schemes to protect renter-households and strengthen the rental market is timely and appropriate to address the circumstances of our times.

- Household Income & Basic Amenities Survey 2019, Department of Statistics Malaysia

- Household Income & Basic Amenities Survey 2019, Department of Statistics Malaysia

- The percentage of income for cost-burdened renters increases to 45% when transportation costs are included.

The Centre is a centrist think tank driven by research and advocacy of progressive and pragmatic policy ideas. We are a not-for-profit and a mostly remote working organisation.